| Operating Scrap Dragon > Main Menu > Back Office > Maintenance > Setup > Program Options > Payments |

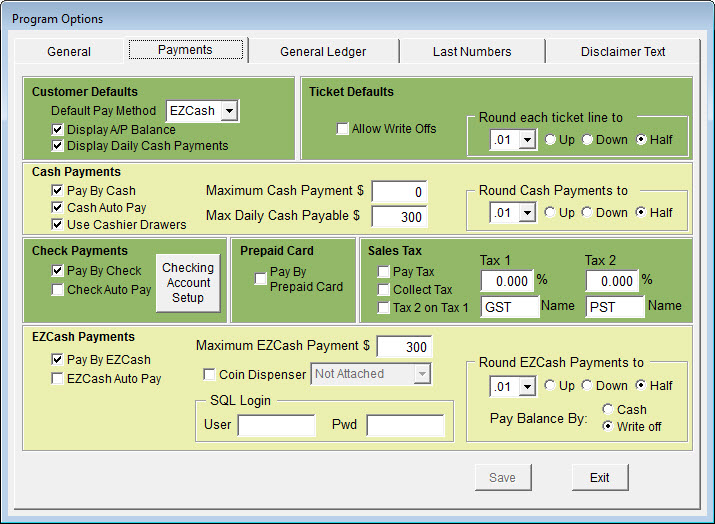

The Payments tab is used to describe the type of payments you make, specifics on the ATM configuration, rounding for ticket calculations, check printing information and Canadian sales tax information. For Check payments, you can elect to permit the check number to be changed at check printing time.

NOTE: If you make changes, you must save each tab individually. If you change tabs without saving, your changes will be lost.

Payments

What payment methods will you be using: Cash, Check, or EZCash? (You may select one or more methods)

As a payment method is selected, the payment option is made available, and the Default Pay Method (for new customers) is available for selection. For example, if you select Cash as a payment method, the payment option Use Cash Drawers becomes available.

ATM Payments

To setup ATM payments, the check box next to Pay By ATM must be checked and the following configurations must be set.

| Maximum EZCash Payment? | What is the maximum amount that you want to dispense for one transaction? |

| Maximum number of bills to be dispensed? |

What is the maximum number of bills to be dispensed? The number of bills dispensed and the denominations of your bills should be considered so that your payments maximum will be allowed.

If your maximum payment is $2000, and your maximum bills allowed is 40, with your denomination being $50, $20, $5, $1, then you will be able to pay a $2000 ticket, but not a $1990 ticket. (40 bills X $50 = 2000) but (39 bills- $50 = $1950 (there is no way to pay the remaining $40 because you would exceed the maximum bills allowed (40) for this payment) So, this payment could not be made at the ATM.. |

| What bill denominations will be used? | What are the denominations of the bills that will be used in the ATM? Consider your maximum number of bills dispensed and maximum ATM payment allowed when determining your bill denominations. If your bill denominations are small, then your maximum number of bills to be dispensed will have to be increased to handle larger payments. |

| What coin denominations will be used? | Enumerate which coins will be used in the coin dispenser. There are four input areas. Input the value of the coins for each input area, for example ( .25, .10, .05, .01 ) |

Rounding

Each ATM payment can be rounded Up, Down or by Half, and the amount to be rounded can be selected. (.01, .05, .10, .25, .50, 1.00)

Select Pay Balance BY method (Cash or Write Off)

For example, if an ATM payment is less than the actual amount due (The Amount Due is $420.12, the ATM dispenses $420), what method will be used to pay the balance?

Sales Tax

If it is necessary for you to pay taxes (on purchases) or collect taxes (on sales), you may select these options on the payments screen. The GST % and PST % amounts can also be set here.

Since all customers are not taxed, it is also necessary to set tax collection information (GST / PST) within the individual customer pages. On the Buy and Sell tab of the Customer File Maintenance screen. These options (tax amounts) can be set for Buying, Selling or both.

Tax will then be included on tickets, invoices, etc. for customers that have had the tax type checked in the customer file.